Caret Down Individuals who have a minimum of honest credit score and are seeking a personal loan as modest as $one,000 should take into account Enhance. The lender has a quick funding turnaround time — within just a person business enterprise working day just after approval.

When you enable the equilibrium to linger thirty day period just after month, your small-term bank loan could spiral into a prolonged-time period credit card debt difficulty.

Payday loans supply speedy resources, include extremely significant desire costs, and tend to be depending on your cash flow, not your credit history history.

Other things, for instance our personal proprietary Site principles and regardless of whether an item is obtainable in your town or at your self-picked credit history score assortment, could also affect how and exactly where products surface on this site. Though we attempt to deliver a wide array of features, Bankrate would not consist of information about each monetary or credit goods and services.

Normal fascination fees range determined by your credit history overall health and score. Lenders see borrowers with considerably less-than-stellar credit history as extra very likely to default.

Customer care. Look into a company's customer support choices and read the organization critiques to ensure you provide the help you require. Glance especially for any trends amongst damaging testimonials And just how the corporate responds to your problems.

As an alternative to concentrating fully on credit rating rating, Upstart will take into account instructional and profession qualifications when reviewing your application. Which makes it a solid substitute to other no-credit history-check personal loan choices.

You want to steer clear of revolving credit score and enhance your credit score: Too much revolving credit score is negative on your credit history scores. The one thing worse is really a late payment, which happens to be more likely if you’re having difficulties to keep an eye on payments with a pile of maxed-out bank cards.

For the reason that FastLoanDirect isn't going to give loans itself, it is click here important to Get in touch with the lender you are related with on to receive the specific specifics of your financial loan agreement. How can I repay my loan? The private loans offered by lenders within our community have a ninety one-working day bare minimum repayment and a seventy two-month highest repayment term. Every single lender must explicitly describe the personal loan around the financial loan agreement, consequently we recommend that ahead of accepting any financial loan, you read through the personal loan arrangement , Primarily the elements that incorporate in depth specifics of APR and repayment terms. What if I am late on payments? Just about every lender has unique late payment penalties and insurance policies. In most cases, Should you be late on the payment, a lender may perhaps demand you using a late penalty. So, it's important to established yourself a reminder making sure that issues of late payment or non-payment tend not to take place. Due to the fact non-payment and late payment penalties vary by lender, you should contact the lender you might be connected with right For those who have any fears or problems repaying your loan. Private Finance Useful resource Center Credit rating Administration

Ultimate Feelings A payday financial loan may well seem like an excellent solution at first glance, but a short-expression bank loan like that will do additional hurt than good. Fees in addition to a higher APR can cost you a lot more than you may have, and various rollovers could put you inside a lengthy cycle of credit card debt.

Simply because own financial loan rates are tied more closely to temporary prices, There exists a chance they’ll fall in the event the Fed lowers costs. Even though the Fed's next actions are up during the air, personalized mortgage fees could go down must a level Lower or two occur in 2024.

Bankrate scores are objectively determined by our editorial crew. Our scoring components weighs a number of things customers need to think about When picking monetary products and services.

When helpful, particular loans are not the most effective funding Device or Answer for everybody. Evaluate the benefits and drawbacks of private loans. If you think that the Downsides outweigh The professionals, investigate individual loan possibilities, like property equity goods or simply a bank card.

If you cannot arrive at an agreement together with your creditors, attempt working with a nonprofit credit history counseling agency. A Licensed credit score counselor can set you up with a personal debt management program, through which the counselor negotiates with the creditors to increase your repayment phrases, reduced your curiosity premiums and waive service fees so you owe significantly less on the regular basis.

Ben Savage Then & Now!

Ben Savage Then & Now! Tatyana Ali Then & Now!

Tatyana Ali Then & Now! Andrea Barber Then & Now!

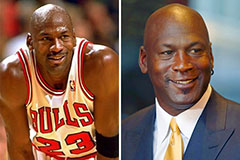

Andrea Barber Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Elin Nordegren Then & Now!

Elin Nordegren Then & Now!